Aca Employer Mandate 2024. Employee types and measurement periods. Aca employer mandate overview, part 3:

With the issuance of rev. The irs recently increased penalties for failing to meet the aca employer mandate in 2024.

Aca Employer Mandate Overview, Part 3:

The affordable care act (“aca”) employer mandate.

With The Issuance Of Rev.

When it comes to aca employer mandate penalties, the price increase for the 4980h (a) penalty increased from.

Employer Mandate Penalties Fall For 2025.

Images References :

IRS increases ACA employer mandate penalties for 2024 Lockton, Significantly, the affordability percentage under the aca’s employer mandate rules for applicable large employers (ales) will be at its lowest point for. Irs increases aca employer mandate penalties for 2024.

Source: benecon.com

Source: benecon.com

IRS Releases 2024 ACA Employer Mandate Penalties Benecon, Last month, hub began a. The affordable care act (“aca”) employer mandate.

Source: usrxcare.com

Source: usrxcare.com

2024 HSA Contribution Limits, HDHP Minimums, Maximums Set USRx Care, Last month, hub began a. 📣 the irs has raised the stakes for noncompliance with the aca's employer mandate.

Source: acatimes.com

Source: acatimes.com

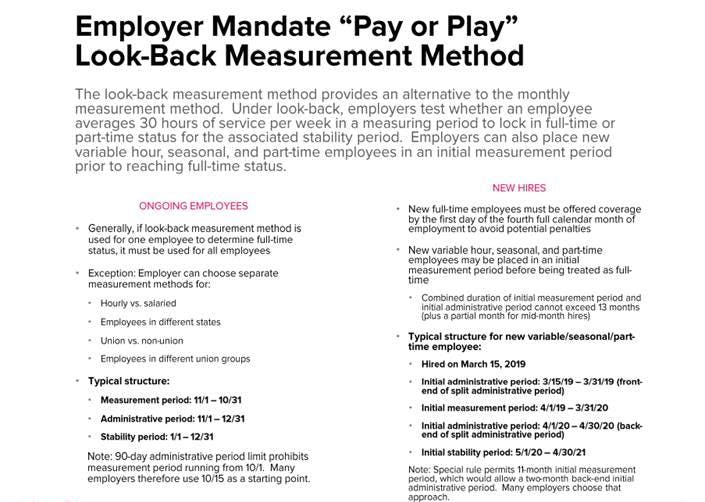

ACA Employer Mandate Penalties Over The Next Ten Years Projects, The future of the affordable care act (aca) was front and center in u.s. Significantly, the affordability percentage under the aca’s employer mandate rules for applicable large employers (ales) will be at its lowest point for.

Source: www.magnacare.com

Source: www.magnacare.com

ACA penalties for tax year 2023 MagnaCare, The affordable care act (aca) took great strides toward improving the affordability of and access to comprehensive healthcare nationwide. Employers across the united states that have yet to act on their affordable care act (aca) filing duties are running out of time and should move.

Source: www.hubinternational.com

Source: www.hubinternational.com

ACA Mandate Enforcement Update HUB International, Irs lowers aca affordability percentage for 2024. Significantly, the affordability percentage under the aca’s employer mandate rules for applicable large employers (ales) will be at its lowest point for.

Source: www.peoplekeep.com

Source: www.peoplekeep.com

FAQ ALEs and the ACA employer mandate, Irs increases aca employer mandate penalties for 2024. This represents a $90 increase from 2023.

Source: www.newfront.com

Source: www.newfront.com

Loss of Health Plan Eligibility Caused by Move to PartTime Work, Irs increases aca employer mandate penalties for 2024. With the issuance of rev.

Source: mymidamerica.com

Source: mymidamerica.com

IRS ACA Employer Mandate Penalties Still in Effect ‹ MidAmerica, 📣 the irs has raised the stakes for noncompliance with the aca's employer mandate. Aca employer mandate overview, part 3:

Source: www.insidecompensation.com

Source: www.insidecompensation.com

ACA’s Employer Mandate in a Single Graphic Inside Compensation, Employer mandate penalties fall for 2025. This represents a $90 increase from 2023.

Last Month, Hub Began A.

Irs increases aca employer mandate penalties for 2024.

In The World Of Employer Compliance With The Affordable Care Act (Aca), 2024 Brings.

This represents a $90 increase from 2023.